Prepare to Sell, Merge, or Close

- Exiting Strategy Options

- Naming Your Price

- Selling Your Business

- Professional Advisors

- Transitioning Your Business

Where do you want to go with your business and what is your desired exit? If part of the plan is to sell your business and go into retirement, do you know what your business will be worth when you sell it? No matter what exit you have envisioned, proper planning will help you make the most of the transition and help to ensure that you realize the real value of your business.

Summary

You’ve decided to move on from your business and you want to be smart about it. Consider the following questions.

1. EXITING STRATEGY OPTIONS

- Do you sell your business?

- Do you consider a business merger?

- Do you liquidate your business?

- Do you rid yourself of responsibility by hiring a manager?

- Do you divest or segment your business in preparation for sale?

- Do you file for bankruptcy?

- Do you close your business?

2. NAMING YOUR PRICE

- What is your business worth?

- Is there a valuation formula for your business?

- How much “good will” do you have?

- What are the legal and tax considerations of selling your business?

3. SELLING YOUR BUSINESS

- Are there buy/sell agreements in place?

- How does your exit strategy affect your personal estate plan?

- What are the legal and tax considerations of selling your business?

4. PROFESSIONAL ADVISORS

- Who will you consult for the best strategy to sell or close the business?

- What kinds of advice will I need?

5. TRANSITIONING YOUR BUSINESS

- How does your business plan support your business transition?

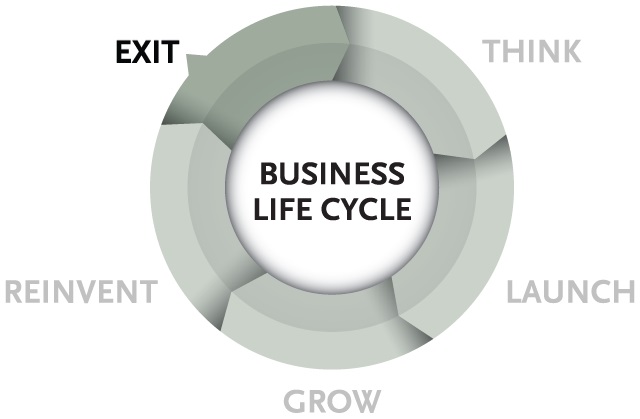

Business Life Cycle Stages

Some of these resources may be self-explanatory, while others might require the assistance of an SBDC Advisor. If you need assistance, contact the SBDC office nearest you.